Apparently, we're at the time of year when companies send you the “we're sorry, but we're forced to raise prices” letter or email.

Nobody is forced to raise prices. It's always a choice. Yes, it's a choice.

Case: Home Alarm Monitoring

My home alarm monitoring company sent an email that included the following text:

“We are committed to continuing to provide you with the highest level of security, service, and support, and we strive to do so as affordably as possible, despite rising business costs including equipment, labor, and fuel.

It is with this in mind that we hope you understand our need to nominally raise rates to continue to protect you at the highest level possible.”

I can understand that equipment and labor costs might be higher than a year ago.

When I tweeted about this, somebody questioned the idea that fuel prices have been going up. I saw unleaded gas for $1.99 the other day here in Texas. Diesel was $2.44.

Does the data get in the way of their story a bit?

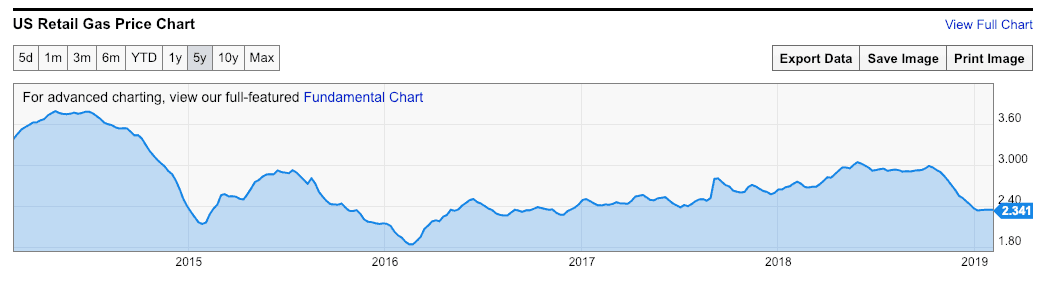

According to YCharts.com, the five-year trend for unleaded gas prices looks like the chart below (and diesel fuel prices seem to correlate pretty well).

Does that look like “increasing fuel prices?” What are they comparing?

Gas prices are lower than 2014. Did the company reduce prices when gas prices were declining and stable? I don't remember the last time they've raised prices, to be honest.

If we want to play the popular two-data-point comparison game:

| Feb 4, 2019 | $2.341 |

| Feb 5. 2018 | $2.753 |

That's not an increase.

But if you choose two other data points:

| Aug 6, 2018 | $2.93 |

| Aug 7, 2017 | $2.492 |

Well, if you take numbers from the middle of the years, it does look like an increase.

I didn't calculate an average gas price for 2018 and 2017. I'm not going to bother creating a Process Behavior Chart, which might shock you.

The main point is:

Customers and the market don't care if you incurred higher costs during the year. Prices are set by the market. If you raise prices too much, even if you feel “forced” or entitled to, customers will eventually find alternatives if you price yourself out of the market.

Case: Lawn Mowing Services

I also got this email from the company that mows our lawn and takes care of shrubs and other plants (a first-world problem to have, I realize):

“This letter is to inform you of some changes that our company is taking due to the increase in expenses throughout the years. Since we have begun this company equipment prices, job supplies, insurance, etc. have all increased and some have more than doubled and will continue to rise. We are proud that our company has not had to send a letter like this in over 10 years, but unfortunately, we have no other choice at this time. We are going to have a price increase effective February 1, 2019. I will be attaching the new contract to this letter.”

“We have no other choice?” I can appreciate that he's not raising the price every year. Maybe he's done a lot of waste reduction and cost reduction in previous years… and maybe now the market commands a higher price.

Ah, that's the thing… prices are set by the market. If you can raise prices without customers complaining or leaving you, you might be reaching the market-set price. Or, you're still lower than what the market will bear.

But, nobody ever wants to send a letter saying, “I'm raising prices because I can, because I want to, and that's what the market is telling me.”

The company that takes care of our yard is very busy. They do really good work, the owner is very responsive about any concerns, and I'm happy with them. If they're super busy and basically turning away work, maybe they should raise their price — again, that's the market talking.

Case: Pet Grooming

I was visiting a clinic once with my veterinarian friend Chip Ponsford. In the pet grooming part of the business, there was a sign on the counter informing customers of the “need” to raise prices 8% or something because “costs are higher.”

It's not hard to find cases like this, so let's turn to Toyota / Lean thinking.

Taiichi Ohno on This Topic

Our friend Ron Pereira wrote a post back in 2007 that references the book Taiichi Ohno's Workplace Management.

Chapter 6 is about this topic of prices, costs, and profits.

The formula of Price = Cost + Profit implies you can choose your price by taking your costs and adding the desired profit margin. That doesn't work well in most markets.

Ohno preferred a formula that said Price – Cost = Profit where the price is set by the market, you can work to reduce your costs, and the end result is profit. Mathematically, the formula is the same… but the implications are very different.

Ron wrote:

“This formula is arranged in such a way as to say that costs exist to be reduced, not to be calculated. The thinking here is that the market sets the price and the only sure way we can increase profits is by reducing costs.”

Ohno wrote that the Price – Cost = Profit formula:

“…applies when you are in competition with other firms selling the same product and the sales price is set by a third party, the customer, based on the value of the product. If it takes 80 yen to produce and the sales price is 100 yen, the profit remaining is 20 yen.”

So, it makes sense then if you can reduce the cost to 75 yen, you've increased your profit to 25 yen. If your cost goes up to 85 yen, you're not entitled to raise your price to 105 yen. You'll lose business to the competitor who is selling at the market price of 100 yen.

You might keep a customer for a period of time due to inertia or other factors. But, if you keep raising prices, you'll probably eventually lose some business. And then, even worse, a company might feel they “must” raise prices on the customers who remain and that's the start of a “death spiral.”

Case: Book Publishing

One continual source of annoyance with the publisher of my first books Lean Hospitals and Healthcare Kaizen is that they seem to feel entitled to raise the price of the books $2 or $3 a year, just because (and the books weren't inexpensive to begin with).

Is the book more valuable over time? Probably not. It probably doesn't go down in value (but you'd have to ask the customers). Sales drop over time, so it seems like there is less demand and the price should go DOWN, not up.

A book that started out at $40 creeps up to near $60 after a few years through a publisher. That's insane. That's bad business. If the marginal cost of printing a copy of Lean Hospitals is about $5, I've tried to make the case to the publisher that selling it at a lower price would likely sell more copies, leading to more profit for everybody involved. But, they're stuck in their ways.

I have gotten a few negative reviews on Amazon about the books being very expensive. That stings because the price isn't my decision — that's on the publisher, completely. That's one reason that I'll probably just continue self-publishing, as I am with Measures of Success. I can control the price… I mean, I can try to keep the price in line with the market.

I'm still deciding on the price for the paperback of Measures of Success. I charge $9.99 for the Kindle version because Amazon gives strong incentives to keep the price below $10.

When I sell it on Leanpub.com, the minimum price is $11.99 (because Amazon insists that their price is 20% less than anyplace else). But, the “suggested” price is $19.99 and some people choose to pay that. Some dial the price down. Some have chosen to pay up to $30.

The paperback version will be printed in color. That's an editorial and design choice that I've made — and I think it's the right choice for a book that criticizes “red/green” analysis of metrics and has a lot of charts. Most books probably don't need color… but this one does.

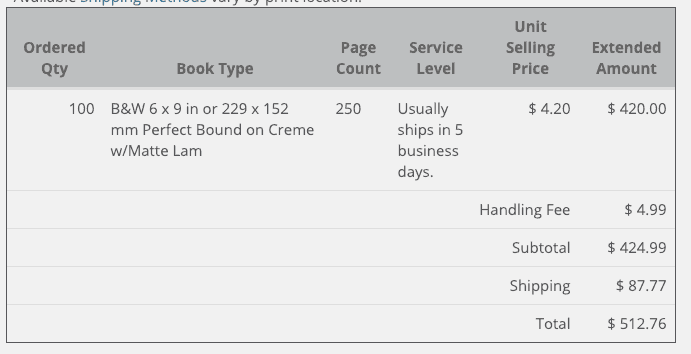

Using color, not surprisingly, increases the printing cost. You can use this printing cost calculator to see for yourself.

Printing and shipping a batch of 100 books would cost $5.12 per book.

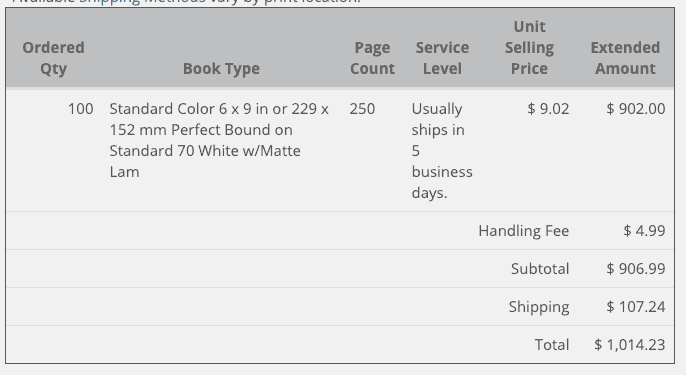

Going to color printing and heavier paper (to prevent bleed through) raises the cost to about $10 a book:

Does the market place a higher value on a color book? Maybe. That's up to each individual reader. What do you think?

I'll probably take a smaller profit margin by doing the color book. My overall business model is not based on selling a ton of books. I want to share and spread ideas. I'm hoping that book sales will lead to more lucrative things like workshops, speaking, and consulting.

But, even if my printing costs went up, I shouldn't feel like I can automatically raise the price, unless that price increase is in line with inflation, perhaps.

Even if we consider inflation, the original Lean Hospitals cost of $39.99 (that's my recollection of the original price) in 2008 dollars would be $46.78 in 2017 dollars, per this calculator. My book now costs $53.95 through the publisher. I wish it didn't.

What happened there? Did the ink supplier tell the printing company that they were “forced” to raise prices, leading the printer to tell the publisher that they “had no choice” but to raise prices, meaning the publisher says we “have to” increase the price to the customer?

Please scroll down (or click) to post a comment. Connect with me on LinkedIn.

Let’s work together to build a culture of continuous improvement and psychological safety. If you're a leader looking to create lasting change—not just projects—I help organizations:

- Engage people at all levels in sustainable improvement

- Shift from fear of mistakes to learning from them

- Apply Lean thinking in practical, people-centered ways

Interested in coaching or a keynote talk? Let’s start a conversation.

Higher prices are the result of a market economy — supply and demand — where the preferred formula is Price = Cost + Profit because cost reduction (via process improvement) is just too difficult an undertaking for most organizations. Also, being “forced” to raise prices is often based on management’s need to hit a financial target that they committed to their owners/investors. Finally, the tariffs have created a convenient excuse for widespread price increases, even those companies not markedly affected by tariffs.

I think increasing the price when faced with a cost increase is the easy way out. Companies should look to find ways to innovate with their product or service. In the case of lawn mowing, they should find ways to branch out their business or find a way to mow more efficiently if they would like to make more profit. At the same time, some companies can raise their price and the consumer will tolerate it because of lack of competition in the area. But when it all comes down to it, the market does decide if a price is too high or too low, and will correct itself when a company can’t sell at the higher price point. An interesting market to look at price movements in the coming years is water. I think we will see price increases when costs are raised because firms will be able to. A resource as precious as water, currently price relatively low, will soon become scarce, and as it is a necessity, the consumer will be forced to pay more.

I really like the way of thinking that costs exist to be reduced, not to be calculated. Instead of raising prices and taking the easy way out of the issue, try lowering your costs. You can substantially increase your profits by reducing some of your costs. Of course if the market is changing you can raise your prices if it calls for it and is justified, but always find ways to reduce costs and save money raising your profits.

I agree that pushing costs on the end user is not the way to approach every cost increase. Prices should only change based on supply, demand, and the customers willingness to buy. Higher costs are instead used as an excuse by some companies to push the price up on their products/services without proper justification based on changes in the market in an attempt to test their customers willingness to buy. Companies should take extensive measures to ensure that they are reducing costs to a degree where they can still sell their product to customers in their target market while still making the same profits or increased profits. As Taiichi Ohno mentioned, price is set by the market, and as such the most effective way for a company to increase profits is to reduce costs incurred. Otherwise, you run the risk of losing business and/or pushing your product into a different market than your target market.

Pricing strategy and it’s associated consumer psychology is actually a really interesting field of study to supplement lean expertise. The mindset of a consumer when it comes to cost is actually very complex (https://www.advancedwebranking.com/blog/eight-proven-pricing-strategies-guarantee-conversions/). Sometimes a higher price can result in perceived higher quality and vice versa (consumers pay high prices at Starbucks because they associate higher prices with higher quality even though that’s completely separate from reality). Sometimes adding a more expensive “premium” product version can increase sales of your mid-range version. And the security company may be giving fuel prices as an excuse because “because” is a powerful word in ability to influence people.

Improving production and service efficiency is almost always a good idea, but cogent pricing strategy can be an even faster and more effective way to drive growth. “Predictably Irrational” by Dan Ariely and “Persuasion” by Robert Cialdini ate great starter reads around the topic.

Increasing price because you feel like you “have to” based on an increase in costs for a business isn’t the best strategy. It leaves the customer with a strange feeling and they will begin to look for alternative businesses to go to that have lower prices. I agree with Ohno’s equation for profit, that if the price is set based on the market, the best way to make a profit is to reduce costs instead of increasing the price.