I've always wondered how you would do investing in Shingo Prize-winning companies. There is quite a bit of debate in the lean blog world about the Shingo committee continuously awarding plant-level lean achievement prizes to bankrupt companies, namely Delphi.

I'm not an investment analyst. But, I put forth this hindsight investing plan:

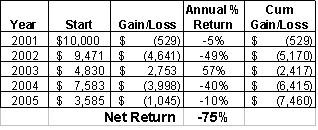

- Starting in 2001, invested $10,000 in a portfolio of Shingo-winning companies. Hold the stocks for a year, then count your gain/loss and reinvest what's left in the next year's Shingo winners.

- I'm approximating a bit by measuring stock returns from Jan 1 to Jan 1 of consecutive years. The Shingo Prizes are awarded in February, I believe.

- Each year, I re-allocated the portfolio by the number of plants from each company that won a Shingo Prize. I had to ignore the privately held or family-held companies.

- Example for 2002: Bridgestone, Delphi (5 plants), Ensign-Bickford (private), Ford (3), Freudenberg-NOK (JV, not traded), Lockheed, Tyco

- I estimated starting and ending stock prices the best I could from Fidelity charts. I didn't obsess over finding the exact stock price, but I think I had the stock prices +/- $1.

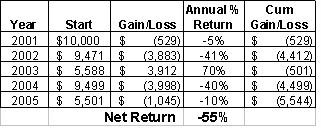

The news isn't good. I even tried to see what would have happened if you ignored Delphi completely. There were a few special cases, such as Tyco, which fell apart for reasons far outside of manufacturing.

The hypothetical portfolio lost money in four out of five years. Starting with $10,000, you would have had only $2540 left after five years. The only good year was 2003, when that year's portfolio returned 57%, thanks to Symbol Technologies stock doubling and Autoliv rising from $8 to $14 a share.

Ignoring and eliminating Delphi, the allocation of each year's portfolio shifted. Since Delphi has won more Shingo Prizes than any other company, 20 of them, their bankruptcy and stock performance severely impacted the portfolio and returns. Without Delphi, the portfolio lost still lost 55% of its value over five years.

So is there a lesson to be learned? I think I wouldn't bet my retirement on the 2006 Shingo winners. For one, Delphi won 4 of the 10 prizes. I believe that Autoliv and Steelcase are the only two publicly traded companies out of the rest. Either way, it's obvious that the Shingo Prize is not a forward-looking indicator of a company's stock price.

Update 3/10/06: Another run of the numbers, including Delphi, but weighting the private companies with the “Russell Small Cap” index as a proxy for the private company stock prices, the portfolio return is still a loss of 59%

Update 3/15/06: Industry Week Best Plants Investing…

Please scroll down (or click) to post a comment. Connect with me on LinkedIn.

Let’s work together to build a culture of continuous improvement and psychological safety. If you're a leader looking to create lasting change—not just projects—I help organizations:

- Engage people at all levels in sustainable improvement

- Shift from fear of mistakes to learning from them

- Apply Lean thinking in practical, people-centered ways

Interested in coaching or a keynote talk? Let’s start a conversation.

![When Was the Last Time a Leader Around You Admitted They Were Wrong? [Poll]](https://www.leanblog.org/wp-content/uploads/2025/07/Lean-Blog-Post-Cover-Image-2025-07-01T212509.843-100x75.jpg)

Nice job! Now I’m wondering about IW Best Plants… although that is more at the plant level.

Dr. Deming’s chart — The New Economics, page 11 — visually will show you why.

Chapter one “How are We Doing” from the same book will explain why.

Here’s a tip….just invest in a company that doesn’t even bother to apply for the

Shamgo Prize…..Toyota….

Many great companies have reaped tremendous benefits from Lean principles but simply have not bothered to apply for any awards. One can argue that the application process is NVA. Also, stock prices reflect a discounting of expected future performance, and by the time you win any award you have already capitalized on much of the improvements and it is reflected in the stock price. Lastly, great performance at the operational level in an industry with a bankrupt business model and poor leadership is a losing game. Toyota does not have the same losing business model.

I disagree with the above argument that lean is a “one time gain” to be recognized. I understand that a stock price is based on projected future performance. Lean is not just a one-time inventory reduction benefit. Lean companies are more responsive and take care of customers. These are lean benefits that continue to grow over time. I doubt that wall street takes those factors into account. I bet they are just looking at cost reductions.

I agree, though, that the Shingo application process itself (as well as other prizes like Baldridge) are NVA.

You are all missing the lesson learned here. Shingo Prize is focused on a production system, not a business system and a plant, not a Business. To improve only one component ( i.e. production plants or productions systems) of a business system is necessary, but insufficient. You must also focus on the Sales and Marketing system, the Product Development System, the Supplier Development System, the Production System, and the supporting enterprise processes. These systems must be connected and focused on delivering value to the customer, while reducing waste, and eliminating variation & over-burdening constraints

I don’t know if it’s a matter of missing the point… I think, through the analysis, we confirmed what you’re saying, that the Shingo Prize isn’t a business prize.

In a way, it’s disappointing for those of us who consider Lean to be a business system, not just a production system.

I’m not sure what your results mean as far as relating Lean to stock price performance. You picked a five year period where the general stock market declined three of the five years. Also, you would need to correlate the results of those companies that received the Shingo prize to their peers and then back out the effect of any company specific non-Lean factors. The point is, your analysis is interesting, but you can’t really draw definitive conclusions from it.

This really is an important question – what should a company expect from going lean? My research shows that some of today’s most prominent corporations apply its underlying principles to create strong, steady, measurable value for their corporations and their customers even advancing during times of uncertainty and crisis (including economic downturns and spiking fuel prices like many firms are facing today). Isn’t this why Toyota set its course to going lean in the first place – as a business solution, a necessary means for overcoming what must have seemed like overwhelming circumstances?

[…] Maybe they needed more Shingo Prizes? Or maybe that’s an Albatross too? […]

[…] leanblog.org, ford buyouts, standard work, shingo prize, lean manufacturing china, conn selmer lean, kanban, gemba walk, lean mfg, nun and the bureaucrat, […]

[…] I still think the ultimate lean measure is PROFIT. Not just short-term profit, anyone can fudge the budgets and the books to show a profit, but long-term Toyota-style sustained profit. Maybe if I have time, I’ll try to research the profitability of the Shingo Prize winners versus their industry peers. (Update 3/10/06 — see my post on “Shingo Investing” here). […]

[…] Lean itself is never the goal. Lean is only the vehicle. It’s the means to an end. And the end is the business performance, over the long-term. But using business results to evaluate the lean efforts is a little like using the regular results of the baseball team to evaluate spring training…it’s a little late to do anything about it. Mark Graban did many years ago a study of the lack of connection between the Shingo Prize and stock performance. […]