In an era where it was a “no brainer” to move factories to China, chasing cheap labor, the Lean world has often spoken out loudly against this. Back in the day, people said “Nobody ever got fired for choosing IBM,” in this era you might say “No CEO ever got fired for moving factories to China. Wall Street applauds the “cost cutting” without looking at the tradeoffs.

China brings cheaper labor (increasingly less so now), but also brings long lead times across the ocean, intellectual property risks, and other challenges (including environmental risks, pictured at left). It's easier to quantify labor cost savings than it is to quantify the business risk of responding slowly to changes in the market.

Regular readers of my blog (and listeners to my podcasts) will remember these stories of manufacturers who have moved work back from China or have avoided going there at all in the name of market responsiveness:

- Jim D'Addario of the D'Addario Company

- Eve Yen (of Diamond Wipes)

The Evolving Excellence blog often features the theme of companies moving work back from China.

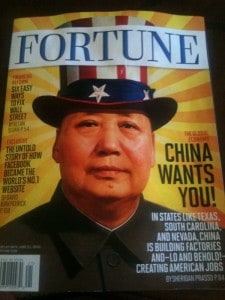

FORTUNE Magazine featured a cover (pictured at left) with Uncle Sam Mao. The story starts by featuring a new factory being built in South Carolina, the American Yuncheng Gravure Cylinder plant.

FORTUNE Magazine featured a cover (pictured at left) with Uncle Sam Mao. The story starts by featuring a new factory being built in South Carolina, the American Yuncheng Gravure Cylinder plant.

Why would a Chinese company build a factory in the U.S.? Because it's cheap here. No joke. Well, that's just one of many factors, including land costs (4x more expensive back in China), and electricity costs.

Yes, labor is more expensive in the U.S., but that's not the biggest factor in many manufacturing companies where labor costs might be 10% of total cost (but they're treated like a much bigger factor than they really are). Hospitals have 70% of their costs in labor and staffing, by comparison).

As the story, “American made … Chinese owned” reports, U.S. states are sending representatives to China to recruit companies:

“The gap between manufacturing costs in the U.S. and China is shrinking,” explains John Ling, a naturalized American from China who runs the South Carolina Department of Commerce's business recruitment office in Shanghai. Ling recruited Yuncheng to Spartanburg, and others too: Chinese companies have invested $280 million and created more than 1,200 jobs in South Carolina alone.

Just as when the Japanese automakers started building U.S. plants in the 1980's, there are some political factors for being here — avoiding tariffs being among them.

There are cultural implications in the workplace – will we have a culture clash as portrayed comically in the movie Gung Ho. As uncreative as Hollywood can be, I'm sure somebody is working on a script that's a remake of the movie with Chinese bosses.

While people in South Carolina and Texas are happy to have jobs, there are some management methods that aren't transferable, as shown in this story about the appliance maker, Haier:

It took Haier some time to work through the issues of being a Chinese employer in a small, historic Southern town (pop. 6,682) lined with stately antebellum houses and home to two Revolutionary War battlefields. “Having a Chinese manager didn't work. That's why they took all the Chinese managers out of here,” says Haier's human resources director, Gerald Reeves, who was one of the first hired by Haier and guided the Chinese through the realities of American-style personnel management — including convincing them that they needed to offer health insurance. He once even asked John Ling, South Carolina's man in Shanghai, to fly home from China to talk to a manager who was arousing employee resentment by publicly embarrassing the workers, Chinese-style, for their mistakes.

Well, that's not just “Chinese-style,” that's the style in far too many American and Western organizations. At least Haier saw that as a problem, much as the hospitals that are moving away from a “blame and shame” culture to a more constructive and collaborative Lean culture.

China wasn't taught by Dr. Deming apparently- I'm thinking to his Point #10 (see all 14 here):

Eliminate slogans, exhortations, and targets asking for zero defects or new levels of productivity. Such exhortations only create adversarial relationships, as the bulk of the causes of low quality and low productivity belong to the system and thus lie beyond the power of the work force.

One Haier factory has this banner hanging:

“Spirit of entrepreneurship — strive for a clearly defined objective and make the impossible possible without an excuse”

Good quality – no excuses! Um, I guess that might work. As Dr. Deming wrote:

Hold people accountable? For what?… What is failure? Whose failure? The employee's failure or the system's failure?

Anyhoo, back to the main point. In my last manufacturing company, they were so slow that they hadn't yet (in 2005) moved production to China for a product that should have clearly been built there. They were big huge industrial products whose customers were mainly in China. The product was built with components from Asia – it was a goofy, convoluted supply chain (as much as I like keeping jobs here, it didn't seem to make sense in that case).

Chinese companies are, believe it or not, building some products in the U.S. to be shipped to China. And there might be good reason:

There aren't enough wealthy customers [in China] yet to make it worthwhile retooling any of the 29 Haier factories in China, but the nearby deepwater port in Charleston, S.C., makes export easy enough.

I'm happy about anything that helps create jobs in the U.S. If you thought the flow of jobs was just a one way street, from the U.S. to China, think again.

Maybe more American companies will learn from China and move more of their production back to the U.S. when it makes sense.

What do you think? Please scroll down (or click) to post a comment. Or please share the post with your thoughts on LinkedIn – and follow me or connect with me there.

Did you like this post? Make sure you don't miss a post or podcast — Subscribe to get notified about posts via email daily or weekly.

Check out my latest book, The Mistakes That Make Us: Cultivating a Culture of Learning and Innovation:

I predict this will happen more and more. For several good management reasons. But also for economic reasons.

China is building up huge capital surpluses. We consume more than we produce and have done so for decades. You can do that by selling off current assets, paying cash you saved up previously, selling off future income (selling bonds, debt…). China has bought tons of USA debt.

It is hard for many to see lending a country that is already buried in federal and state debt and consumer debt (corporate debt is actually better today than a decade or two ago when the MBAs were constantly taking healthy companies, leveraging them to the hilt, leading to inevitably bankruptcies). Many MBAs still push this kind of thinking (and so companies continue to put themselves at risk, but many companies are resisting the temptation (for someone with a short few year focus building up leverage is a successful way to build up big bonuses) to put the company at risk.

So taking on more USA debt just doesn’t make that much sense for China (from where I sit). That means, either stop financing the USA living beyond its means or take past wealth instead (things like factories; companies that build, service, insure…; real estate…). I don’t see the USA as likely to stop living beyond its means soon. I don’t see China deciding to stop funding it. I see China buying more USA real estate, factories, companies…

China is actually likely to continue to invest a great deal in China too and increase spending on increasing living standards. China has been saving huge amounts (rather than consuming beyond its means China has been living below its means). But China has showing more increases in consumer spending and that seems likely to continue.